Dispelling the most common myths about the VA hybrid ARM Loan

Not all ARM loans are created equal!

Featured Videos

Dispelling Common Misconceptions

VA Hybrid ARM

Understanding the VA hybrid ARM

5/1 ARM

Minimum Credit Score for VA Loan

VA Hybrid Loan vs 30 Fixed Rate Loan

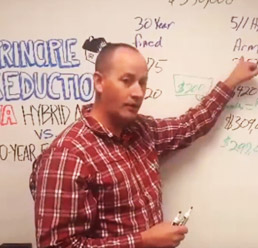

Principal Reduction With a VA Hybrid Loan

Save money with VA Hybrid Loans

Veterans can save more money with VA Hybrid Loans than they could with a conventional fixed-rate loan or ARM.

Experts predict a rise in real estate interest rates in the not too distant future. Hopefully, they'll never get to the 18% they were in the 1980s, but anything is possible. If this did happen again, some folks would have a hard time keeping up with their payments as they continued to rise.

Luckily the VA Hybrid loan can offer some protection against these rising rates, especially if you lock in now.

If you're looking for some stability and have heard that ARMs may not be the best choice for you, you should really look at VA Hybrid Loans. Most people stay in their homes for about 7 years. So VA Hybrid Loans with fixed periods of 3 or 5 years would offer you security during this time.

Although your interest rate will adjust after the initial fixed-period, thanks to the yearly cap of 1% you'll be shielded from interest rates that are rising much quicker. If rates are rising at 3% per year, you save 2% by getting in a safe VA Hybrid Loan. Additionally, you'll have a lifetime cap of 5% from where you started. A loan that starts at 2.25% will only rise to 7.25% max. If either of these caps don't give you enough assurance, or you find you want to get out of your VA Hybrid Loan, you can always streamline out it later.